- Home

- Course finder

- Work-Study Diploma in Accountancy

Work-Study Diploma in Accountancy

ITE College Central

Work-Study Diploma

Work-Study

Accountancy

Administrative Support

Financial Services

Course duration: 30 months

This Work-Study Diploma course aims to equip graduates with knowledge to perform accounting and financial reporting using cloud accounting software, plus utilising data analytics techniques to generate appropriate accounting information to enable management to formulate plans, control operations and make business decisions.

The course also enables them to conduct audits of financial statements in accordance with the Singapore Standards on Auditing (SSAs) while upholding ethical principles. Graduates will be able to prepare tax computations of tax liability for companies and leverage on tax incentives and allowances as tax planning strategies for the companies.

^ New for 2024, and content is subject to developmental changes

Prerequisite

Understand the basics of Accounting, such as journal entries and possess strong numeracy skills.

Job role

The job role of Accounts / Tax Executive includes and is not limited to provision of Accounts Receivable and Accounts Payable services, performing month end closing activities and bank reconciliation, preparation of financial statements, computation of assessable income and preparation of tax schedules and computation of production cost.

The job role of Advisory Associate includes and is not limited to assistance in planning of the Audit, evaluating internal controls to assess effectiveness, performing substantive testing procedures, assessing adequacy of tax provision, review financial statements, notes and schedules.

Work-study training pattern

Day Release - One day of classroom lessons per week at ITE, with the remaining work-week spent at the workplace for On-the-Job Training.

Click here for Course Module Details [PDF, 511 KB]

Some of our partners

CLA Global TS | 1FSS Pte Ltd | Numbers Management Pte Ltd | Philip Liew & Co | ForBis Accounting Pte Ltd

Employers that wish to offer training places, please click HERE.

What you'll learn

Perform financial accounting for small entities

Prepare reports to support strategic planning

Perform assurance engagement in compliance with professional standards

Perform corporate reporting in compliance with financial reporting standards

Prepare statutory tax filings

Perform data extraction and analysis using software and business intelligence tools to generate reports to support decision-making

Entry requirements

Applicants must meet the following minimum entry requirements:

ITE graduates from any one of the following courses + pass company screening & interview;

Nitec with GPA ≥ 2

Business Administration

Higher Nitec:

Accounting (2 years)

Accounting (3 years)

OR

In-service employees+ with:

Equivalent qualifications such as Workplace Literacy & Numeracy (WPLN) Level 5 and above

Minimum 18 years old with at least 2 years of full-time relevant work experience

Strong employer endorsement

+In-service employee may be invited for an admission interview

Career opportunities

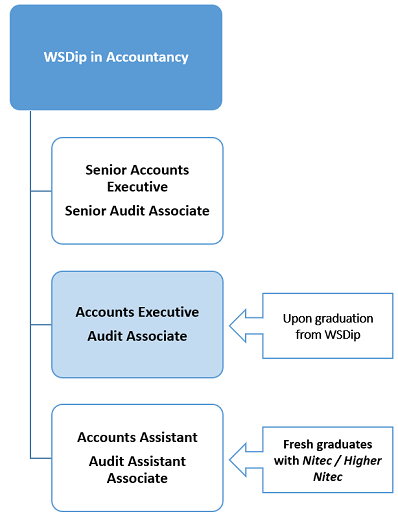

On completion of this diploma programme, you can take up jobs as Accounts Executive & Audit Associate.

For general queries on the course, please refer to https://www.ite.edu.sg/about-ite/contact-us.

Pantone-01.png)